Table of Contents

ToggleAbu Dhabi Real Estate Market

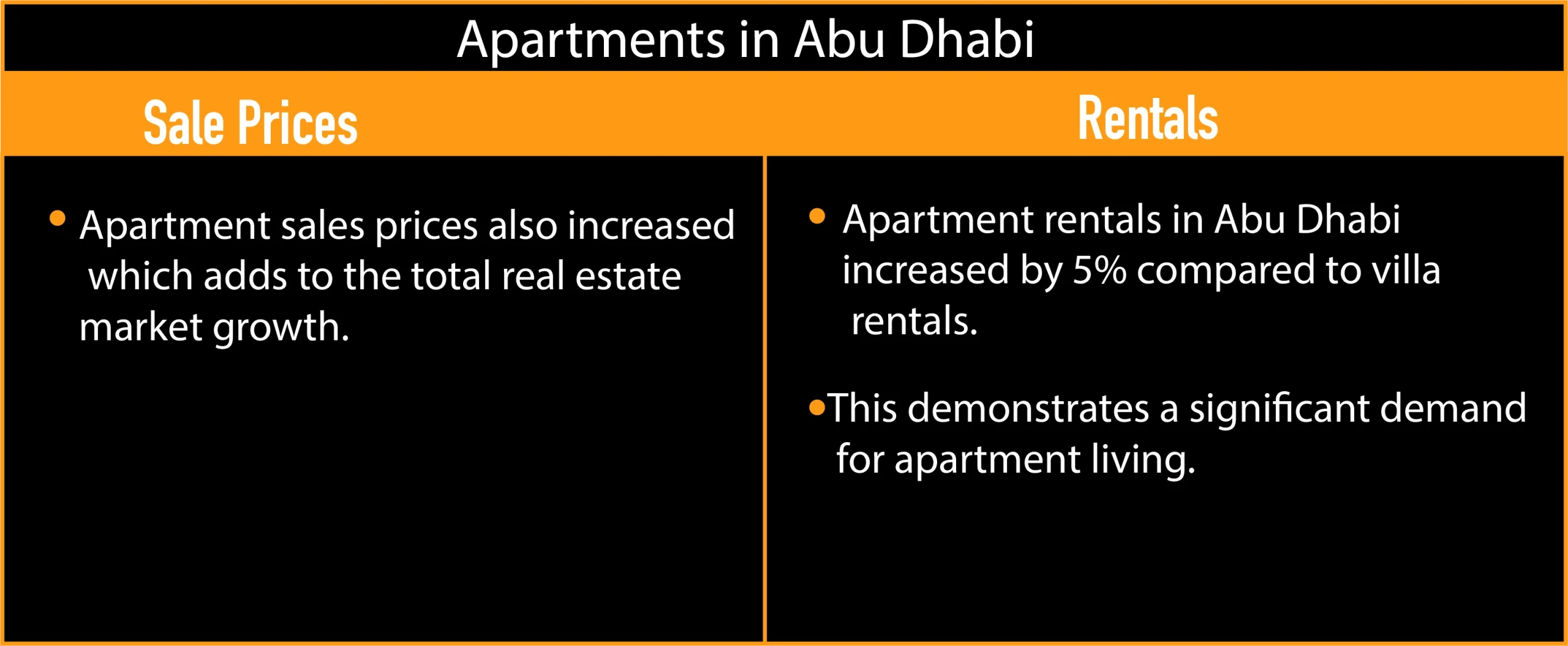

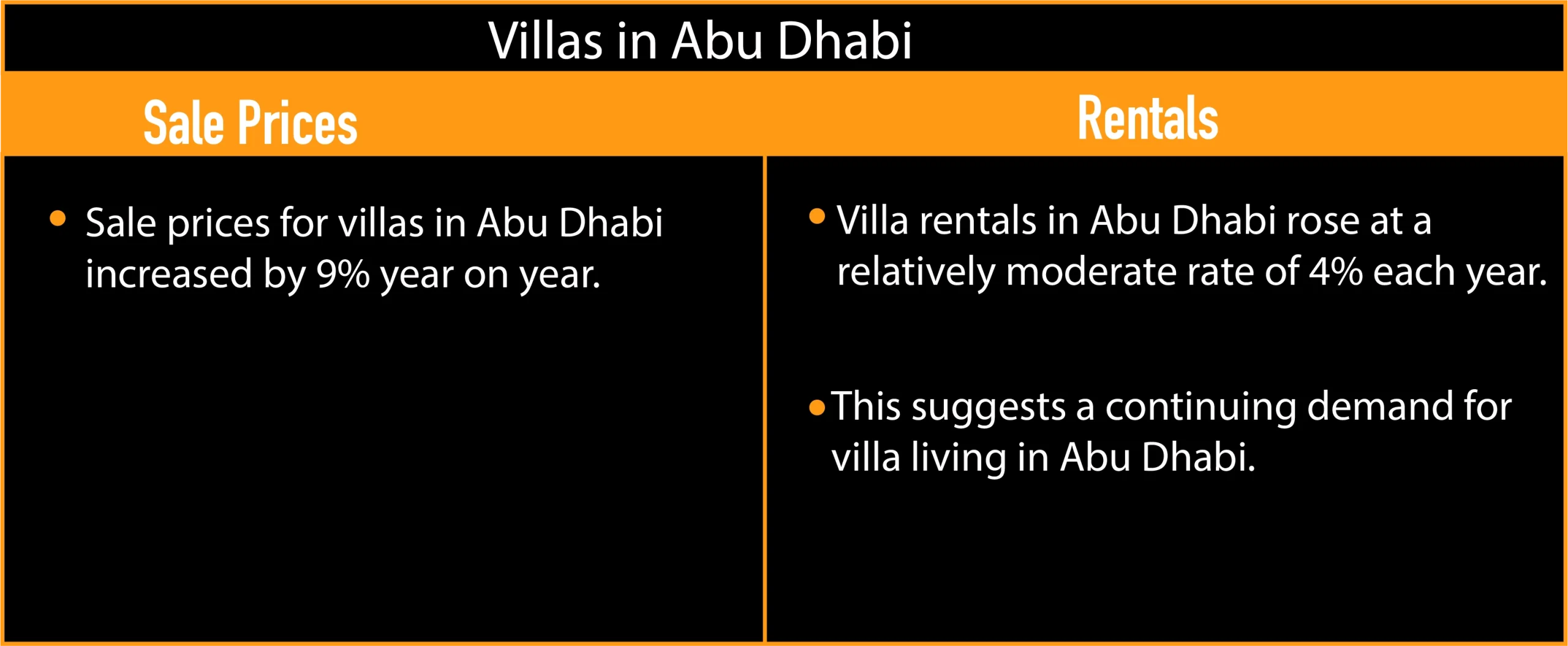

Abu Dhabi’s real estate market continues to thrive thanks to high demand, thriving economy, and substantial investor interest. Sales prices increased by 7% and rental rates by 4% in Q1 2024. High transaction volumes and growing property values reflect a strong market, making Abu Dhabi a desirable place to invest.

Is the Abu Dhabi real estate market booming?

The UAE’s property market is evidently expanding rapidly. This is due to strong demand, a thriving economy, and substantial foreign interest. The Abu Dhabi real market also had good trends. It has sales prices growing by an average of 7% and rental rates jumping by 4%. This is in reference to the Q1 2024 UAE Real Estate Market Overview report of JLL MENA. Additionally, Reidin generated numbers that show a similar pattern in their residential property price report 2024. The Abu Dhabi Residential Property Sales Price Index decreased by 0.06 points in April 2024. That is, from 85.87 to 85.81 which marks

a slight month-on-month decline of 0.07%.

However, on a year-on-year basis, the index saw a 7.12% increase. This indicates overall growth in Abu Dhabi property prices despite the recent minor dip. This annual increase indicates high demand and a healthy long-term trend in the Abu Dhabi real estate market.

Meanwhile, the Abu Dhabi Residential Property Rent Price Index showed an increase of 0.74 points in April 2024. It rises from 75.79 to 76.53. This represents a month-on-month increase of 0.98%.

Additionally, the index recorded an 8.49% year-on-year increase. This indicates a steady rise in rental prices over the past year. This upward trend reflects a robust demand in the rental market. Hence, making Abu Dhabi an attractive destination for property investors seeking consistent returns.

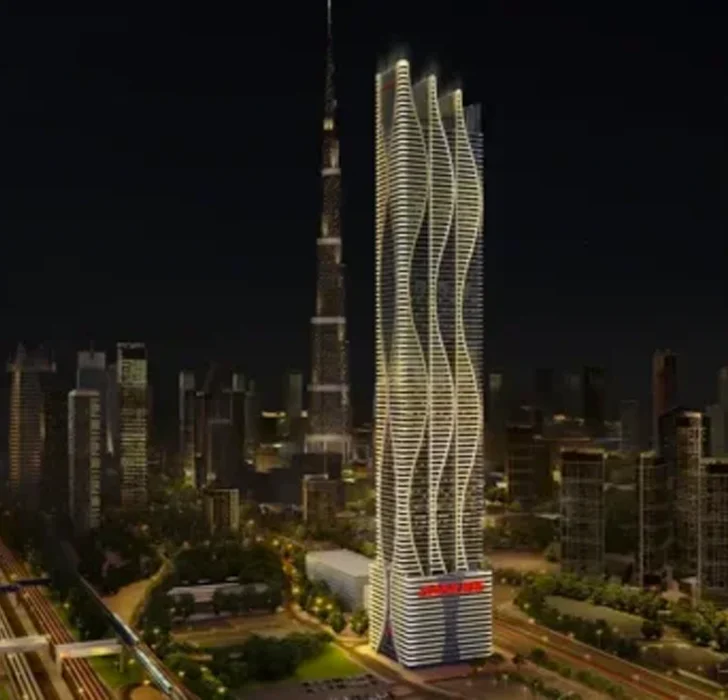

Most Trending Projects in Dubai for You to Pick.

Abu Dhabi Real Estate Market Trend

In Abu Dhabi, the housing market also grew by 7% in sales and 4% in rent in Q1 2024.

Property Demand in Abu Dhabi

Property demand in Abu Dhabi also remains strong. According to the Department of Municipalities and Transport (DMT), the amount of transactions increased to 13,298 in 2023.

This is a significant 75% increase from 7,957 in 2022.

The total transaction value also increased by 120% year on year. Hence, reaching AED 44 billion (US$11.98 billion) against AED 19.9 billion (US$5.42 billion) the previous year.

Furthermore, the strong demand is going to endure up to this year of 2024. In Q1, total real estate transactions in Abu Dhabi were AED 15.9 billion (US$4.32 billion). This includes 5,127 sales and mortgage transactions.

In particular, 2,919 sales and purchase transactions have been reported. This totals over to AED 9.6 billion (US$2.61 billion), as well as 2,208 mortgage arrangements for AED 6.3 billion (US$1.72 billion).

Why should you buy properties in Abu Dhabi?

Beneficial for Expats

In 2019, there was an implementation of a new system of long-term residency visas (Golden Visa). This enables international investors and professionals to live in the country without the need of a national sponsorship. They might also have full ownership of their business. These visas are valid for the next 5 or 10 years.In 2022, the UAE government implemented

new requirements for acquiring a Golden Visa through investment.

This includes a lower investment limit and no restrictions on the duration of residence in other countries. Most importantly, they gain the ability to acquire off-plan properties. The new restrictions went into effect in October 2023.

To obtain a 10-year Golden Visa, investors must purchase real estate in the UAE worth AED 2 million (US$545,000). Alternatively, you can obtain a two-year resident visa by purchasing real estate worth AED 750,000 (US$204,000).

Benefits:

- Moving to the UAE or establishing a "safe haven"

- Tax optimization

- You can open a bank account in the UAE

- Getting a driver's licence

- Access to the UAE's medical and educational systems

- An easy route to get a resident visa

- Visas for the entire family

- Obtaining an Esaad Privilege Card

- A possibility to obtain UAE citizenship

Abu Dhabi Real Estate Market Continuous Housing Supply

Abu Dhabi’s entire stock remained constant at 3.9 million square metres. It had no substantial fresh deliveries during the year.Looking ahead to 2024, Abu Dhabi will add around 112,000 square metres of new office space.In this regard, the Abu Dhabi real estate market already had a solid start to the new year. In Abu Dhabi, 1,600 units were delivered on a consistent basis.

High Rental Yields in Abu Dhabi Real Estate Market

Abu Dhabi real estate market’s resilience over the years has won the trust and credibility it deserves. Additionally, real estate investors find Dubai and Abu Dhabi to be particularly appealing. This is primarily because the rental yields in other emirates are often lower.

Abu Dhabi

Gross rental yields in Abu Dhabi were barely different from 6.31% a year earlier in April 2024. However, they were still relatively high at an average of 6.46%. The specific numbers are:

FAQs

Yes, real estate in Abu Dhabi is a good investment. This is due to its stable market, steady price appreciation, and strong rental yields.

Yes, foreigners can buy property in designated investment zones in Abu Dhabi.

Yes, buying an apartment in Abu Dhabi can be worthwhile. The city is famous for its high standard of living, robust infrastructure, and rental market.

Owning property in Abu Dhabi provides advantages. Particularly, capital appreciation, substantial rental yields, tax-free income, and an elevated lifestyle.

Yes, buying property in Abu Dhabi can qualify you for a UAE residency visa.

Most Trending Projects in Dubai

kashish awan

Share This Post

Found this information useful? Share it with your friends and family!

Leave your information so that our expert can consult you in the best way possible

Share your details for personalized expert guidance – let us assist you in the most effective way!