Secure Your Home Loan with APIL Properties

With the help of our professional mortgage consulting services, you may begin your home-buying journey in Dubai with assurance. Start your journey now

- No impact to your credit score

- Transparent, no hidden fees

- Pre-qualify within minutes

Why trust APIL Properties for your Home Financing Needs?

Finding your dream home can be a challenge. Our dedicated expert consultants can provide you with personalised guidance to keep you on budget and on track every step of the way.

Top-tier Advisors

Our esteemed advisors offer first-time homebuyers professional advice and comprehensive assistance. They will guide you through your home-buying journey step by step.

Free Consultations & No Fees

Enjoy cost-free consultations with no additional costs. We guarantee complete openness all the way through the house-buying process.

Free Mortgage Calculator

Use our free mortgage calculator to quickly create a budget and look into possibilities for home ownership options that suit your budget and preferences.

Exploring Options

Use our free affordability calculator to determine how much you can afford for your dream home.

Home Hunting

With our top-rated experts, you may get pre-qualified within minutes. Start making your move as quickly as you can.

Ready to Purchase

Access free consultation with experts. Get in touch with our highly regarded consultants to choose the right mortgage for you.

How to Finance Your Home in Dubai with APIL Properties?

Not sure where to begin your home-buying search in Dubai? Here’s a basic guide to help you get started.

Invest some time reviewing your credit score and income. For the next six months, avoid taking out loans, opening credit cards, or making major purchases. Then, use our free affordability calculator to quickly determine how much you can pay.

Get an estimate of how much you can borrow so you can comfortably browse for homes that fit your budget. Our top-rated consultants can pre-qualify you within minutes, with no fee.

Getting pre-approved from a lender allows you to make an effective and competitive offer. Our expert consultants will guide you through sourced home mortgages from banks that are registered by the DLD. Rather than navigating the mortgage process alone, it is better to have experts to guide and support you all the way.

When looking for a mortgage in Dubai, it is critical to understand the many options accessible. These often comprise both fixed-rate and variable-rate mortgages. To get the best house loan for you, consider your financial situation as well as your long-term ambitions.

Obtaining a pre-approval letter is an important step in applying for a mortgage loan in Dubai. This formal document issued by the bank acts as proof of your eligibility for housing financing. It outlines your maximum borrowing limit and assures you of getting a house loan. It gives you peace of mind while you go through the home-buying process.

After the seller accepts your offer, you can begin with the official mortgage application for your new property. Our top-rated consultants will provide expert advice for your specific circumstance at every stage.

Once your loan is accepted, the lender schedules a closing date and does a final credit check.

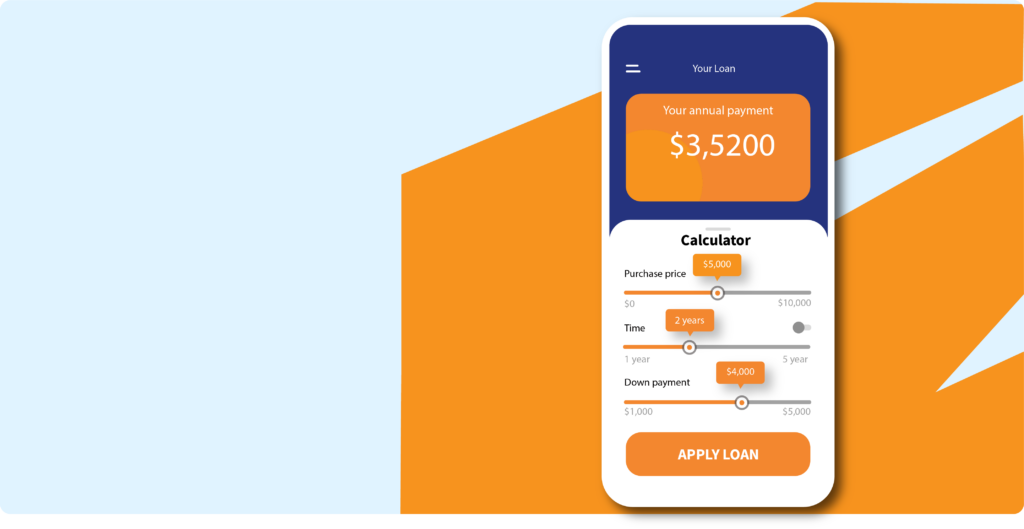

Mortgage Calculator

The Mortgage Calculator is a must-have tool for prospective homeowners in the UAE. This provides quick and clear insights into the potential investment and financial consequences of home ownership.

Property Value Estimation

Determine the value of the selected property.Calculate a reasonable pricing range according to current mortgage rates in Dubai.

Resources for Mortgage Planning

Understand the mortgage costs more clearly.Help with good financial planning by outlining prospective monthly payments and total costs during the loan term.

Affordability Calculator

Use our Affordability Calculator to figure out how much you can borrow and the property value you can afford. Let us help you prepare to make an offer on your dream property in Dubai.

Monthly Income

Your income is a key factor in determining how much you can borrow. Lenders must verify that you can make repayments to prevent defaulting on your loan. In

Monthly Debt

UAE lenders utilise the Debt-Burden-Ratio (DBR) to determine your borrowing capacity. The DBR calculates your monthly debt (including future mortgage

Initial Payment

Non-UAE nationals are required under the UAE Mortgage Cap law to contribute a cash down payment equal to at least 25% of the property's worth (20% for UAE nationals) plus related purchase costs.

Refinance Calculator

Are you thinking about refinancing your existing mortgage in Dubai? Our refinance calculator can help you assess whether it is a viable choice for you. You can estimate your potential savings by entering information about your existing and future loans.This free tool allows you to assess the advantages of refinancing. For instance, lowering your monthly payments, extending the length of your loan, cancelling your mortgage insurance, upgrading your loan program, or lowering your interest rate. Our refinance calculator gives essential information to help your decision-making process. Whether your goal is to save money, decrease your loan term, or improve your mortgage structure.

What is Mortgage Refinancing?

Refinancing includes replacing an existing mortgage with a new one. This may have different terms and conditions. This can involve a varied interest rate, loan amount, or repayment plan. Refinancing provides an opportunity to save money by obtaining better conditions, such as a lower interest rate, than your current mortgage.

How Refinancing Works in The UAE

Refinancing your mortgage in the UAE is a basic process that applies to both UAE nationals and expatriates. It requires submitting

an application with the necessary paperwork, after which partner banks will determine your eligibility. Upon approval, you sign a new mortgage loan agreement and begin making payments on the new mortgage.While refinancing can result in savings, it is critical to understand the related risks. Our team of professionals can assist you in weighing the advantages and downsides. This ensures that you choose the best option for your needs.

Mortgage Calculator

With our user-friendly mortgage calculator, you can easily estimate your monthly mortgage payment. Gain a comprehensive understanding of your upcoming costs so you can confidently organise your finances.

Affordability Calculator

How much housing can you afford? Using our affordability calculator, you can calculate how much you can afford to spend on a new house.

Refinance Calculator

Use our refinance calculator to determine whether refinancing is a good option for you. Assess potential savings quickly and easily to determine whether it is the best decision for your financial future.

Leave your information so that our expert can consult you in the best way possible

Share your details for personalized expert guidance – let us assist you in the most effective way!