Table of Contents

ToggleThe biggest disadvantage of Investing in Real Estate in Dubai

Dubai has become a sought-after location for real estate investment, driven by its thriving economy, attractive tax policies, and promising rental yields. Nevertheless, like any investment, there are associated risks. But investors ask what is the biggest disadvantage of investment in real estate. One notable challenge in Dubai’s real estate market is the risk of oversupply and low occupancy rates. Despite the city’s rapid growth, concerns have arisen regarding the oversupply of properties in certain areas, potentially leading to lower occupancy rates and reduced rental income for investors. The impact of the COVID-19 pandemic has exacerbated these challenges, with financial difficulties affecting businesses and individuals and contributing to the oversupply issue.

Investing in Dubai's real estate market also entails drawbacks like high transaction costs, legal complexities, and the requirement for a local sponsor for property purchases. While there are definite real estate advantages to investment, it's crucial for investors to thoroughly assess potential risks and drawbacks before making decisions but you should also know advantages and disadvantages of real estate investment.

Financial Risks and Market Volatility plays a huge role in disadvantage of Investing in Real Estate in Dubai

Investing in real estate in Dubai can be attractive, yet it involves financial risks and market volatility. Financial risk in real estate pertains to the possibility of financial loss or harm resulting from factors like market fluctuations, sensitivity to interest rates, and concerns about liquidity. It is crucial to comprehend these risks thoroughly before making any investment decisions.

Liquidity Concerns

One notable drawback of real estate disadvantages in Dubai is the concern over liquidity. Real estate investments lack the liquidity found in stocks or bonds, making it challenging to swiftly sell a property. Finding a buyer may take months or even years, restricting access to funds during this period. This limited liquidity poses a significant disadvantage, particularly when a quick need for cash arises.

Interest Rate Sensitivity

Another financial risk linked to real estate investment in Dubai is interest rate sensitivity. Real estate investments are responsive to changes in interest rates. When interest rates climb, borrowing costs increase, potentially resulting in higher mortgage payments. This escalation can have adverse effects on cash flow and diminish the overall return on investment.

Market Fluctuations

Real estate investments are influenced by market dynamics, causing property values to fluctuate and impacting your overall investment returns. In a real estate market downturn, property values may decrease, posing a risk of capital loss.

Legal and Regulatory Challenges is also a major point in disadvantage of Investing in Real Estate in Dubai

Investing in real estate in Dubai can be intricate due to legal and regulatory challenges. Navigating these complexities poses a difficulty for investors in comprehending associated risks, potentially resulting in substantial financial losses.

Ownership Laws

Real estate investors in Dubai encounter a significant legal challenge related to the country’s stringent ownership laws.

These laws generally restrict non-citizens from owning property in specific areas of the city, potentially limiting their investment options.

Even when ownership is permitted, non-citizens might face limitations on the type of property they can acquire or the amount of land they can own.

Zoning and Compliance

Real estate investors in Dubai also grapple with significant challenges related to the country’s zoning and compliance regulations.

These regulations, often intricate and challenging to navigate, carry the risk of substantial financial penalties for non-compliance.

Moreover, zoning rules may impose restrictions on the types of properties that can be developed in specific city areas, potentially constraining the investment possibilities for investors.

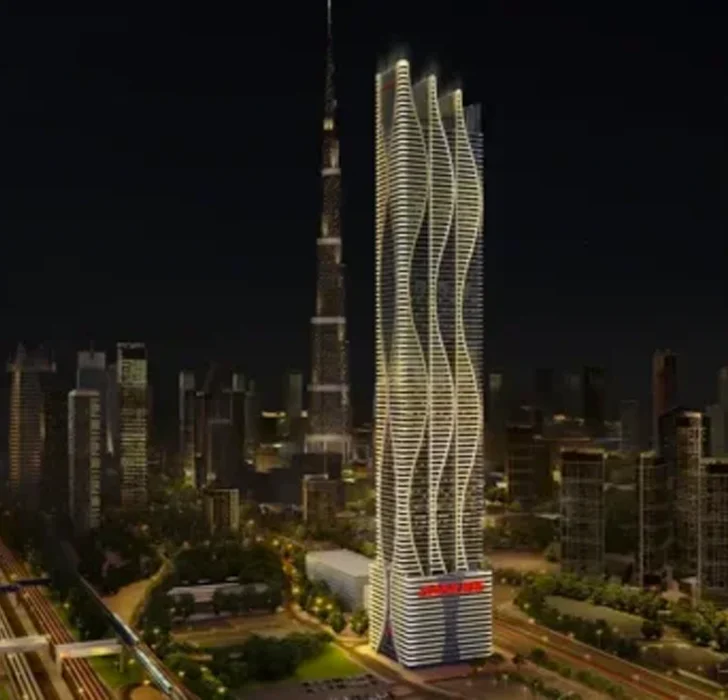

Most Trending Projects in Dubai for You to Pick.

Economic Factors and Market Dynamics also considered while looking for disadvantage of Investing in Real Estate in Dubai

Dubai's real estate market has experienced substantial growth, and investors need to carefully evaluate both its advantages and disadvantages in real estate. Consideration of unique economic factors and market dynamics in the emirate is crucial before making any investment decisions.

Economic Downturns

Investing in Dubai’s real estate comes with a notable drawback – its vulnerability to economic downturns.

The market experienced a substantial decline in property prices during the 2008 global financial crisis, and a similar scenario unfolded during the COVID-19 pandemic, leading to reduced property values in specific areas.

Economic downturns can pose challenges for investors, impacting their ability to sell properties or generate rental income and potentially resulting in financial losses that make it one of the biggest disadvantages of investing in real estate in Dubai.

Supply and Demand Imbalances

Investing in Dubai’s real estate faces another challenge – imbalances in supply and demand in specific areas.

While there’s considerable demand in popular areas like Dubai Marina and Downtown Dubai, there’s also a notable oversupply in other regions. This oversupply dynamic can result in decreasing property prices and challenges in finding tenants.

Investors must conduct thorough market research to identify areas with a more balanced supply and demand scenario before making investment decisions.

Conclusion disadvantage of Investing in Real Estate in Dubai

There may be advantages and disadvantages when you choose to invest in Dubai real estate. But investing is about taking calculated risks. It is important to first learn about different challenges and risks so that you can have a successful investment with great returns.

FAQs

Dubai's real estate market's lack of liquidity can pose challenges for investors, impacting the ease of property sales and potentially leading to lower-than-expected sale prices. The market's illiquidity may hinder investors from effectively diversifying their portfolios, increasing overall risk exposure.

While fluctuations can offer short-term profit opportunities, long-term investors may face risks, especially if they purchase properties at high prices and the market experiences a downturn.

Non-GCC nationals may need a No Objection Certificate (NOC) from the Dubai Land Department. Moreover, awareness of substantial fees and taxes associated with property purchases is crucial for informed decision-making.

Dubai's oversupply situation can result in stagnant or decreasing property prices, impacting investors' ability to realize profitable returns.

The market's lack of rental yield stability poses a risk, making it challenging for investors to predict and plan for consistent returns due to various factors like oversupply, regulatory changes, and economic shifts.

Most Trending Projects in Dubai

Adil khan

Share This Post

Found this information useful? Share it with your friends and family!

Leave your information so that our expert can consult you in the best way possible

Share your details for personalized expert guidance – let us assist you in the most effective way!