Dubai's 2024 Real Estate Market Demands And Opportunities

Dubai’s 2024 Real Estate Market Demands reflects a landscape marked by notable shifts and substantial growth. Dubai’s real estate market is important for the city’s economy and global status this year. Its significance transcends beyond local esteem from local stakeholders but also garnering interest from investors around the globe. In the following sections, we will delve deep into the Dubai’s 2024 Real Estate Market Demands. We’ll specifically highlight Dubai’s 2024 Real Estate Market Demands, forecast for the Dubai’s 2024 Real Estate Market Demands. As well as the real estate investment opportunities in Dubai. We’ll also cover the growth prospects in the Dubai’s 2024 Real Estate Market Demands.

Table of Contents Dubai's 2024 Real Estate Market Demands

Most Trending Projects in Dubai for You to Pick.

Dubai's 2024 Real Estate Market Demands

According to Haider Tuaima, director and head of real estate research at ValuStrat, residential prices in Dubai are steadily rising.

This is by 5% to 7% in the first months of the year. However, Mr. Tuaima predicted that the market would reach an inflection point in the later part of 2024. Thus, affecting the high-end luxury sector first.

The real estate market is now experiencing strong transaction activity and consistent price appreciation. However, analysts predict a shift in market dynamics by mid-next year. This predicted shift could have an impact on the path of the high-end luxury market. It will either stabilize or potentially commence a price correction.

However, co-chairman of Sobha Group Ravi Menon hints at this inflection point. Saying that this will not have much impact on Dubai’s entire dynamic real estate. Analysts suggest that these issues may stem from reduced purchasing power. And also the trend among buyers to downsize (tendency to opt for smaller or less expensive options).

Moreover, Mr. Ravi Menon mentions that more people are to visit and invest in Dubai. The largest investors often come from the United Kingdom, China, and India. As well as the Commonwealth of Independent States (CIS) markets, and the rest of Europe, this trend is likely to continue.

Furthermore, Mexico, Canada, and Latin America might also participate in the emirate's property market, boosting demand even further. Furthermore, investment from Chinese investors is likely to increase this year. As the world's second-biggest economy bounces back from pandemic restrictions.

The housing market in Dubai is predicted to stay stable in 2024. There is not much worry about a slowdown in the middle of the year.

The UAE's stable economy and investor-friendly rules contribute to the success of Dubai's real estate market. Moreover, measures such as giving long-term resident visas to real estate investors. Or loosening foreign ownership laws have significantly influenced the market. Essentially, there are three emerging trends that highlight investor preferences in Dubai's real estate market.

Technology Integration

Dubai emerges at the forefront in the digital realm of real estate. It is one of the first to integrate this technological advancements. That is, Dubai holds the pioneering role in the early adoption of cryptocurrencies for real estate transactions. Thus, showing that they are ahead in technology integration.

Additionally, the integration of blockchain technology might change real estate property dealings. As this offers increased speed, security, and access. This digital leap forward not only optimizes processes. But also solidifies Dubai's reputation as a hub of efficiency and innovation.

Sustainable Development

Dubai’s 2024 Real Estate Market Demands sector already started to undergo a significant shift towards eco-friendliness. This is amidst the urgency for climate action emphasized by the COP 28 summit. The city recognizes its significant contribution to global emissions. And thus the industry responds with a notable rise in green property development.

Luxury Housing Demand

Dubai maintains its stronghold in the luxury property sector, experiencing record sales of high-value homes. There is an evident influx of affluent individuals seeking distinct real estate experiences which Dubai mostly offers.In Dubai’s 2024 Real Estate Market Demands market 2024, a trend emerges in off-market transactions. This is for luxury villas and penthouses. Particularly true in prime locations like Palm Jumeirah, Downtown, jumeirah bay and damac hills.

The market reflects a growing environmental consciousness among affluent people which leads to an increased demand for sustainable homes. Notably, developers like DAMAC Properties, Nakheel, Meraas, Binghatti, and Emaar properties are actively responding to this trend. They have projects such as DAMAC UTOPIA luxury villas in Damac Hills. Or Mercedes Benz Places by Binghatti and Address Residences by Emaar. These align with the evolving expectations of affluent individuals in the real estate market.

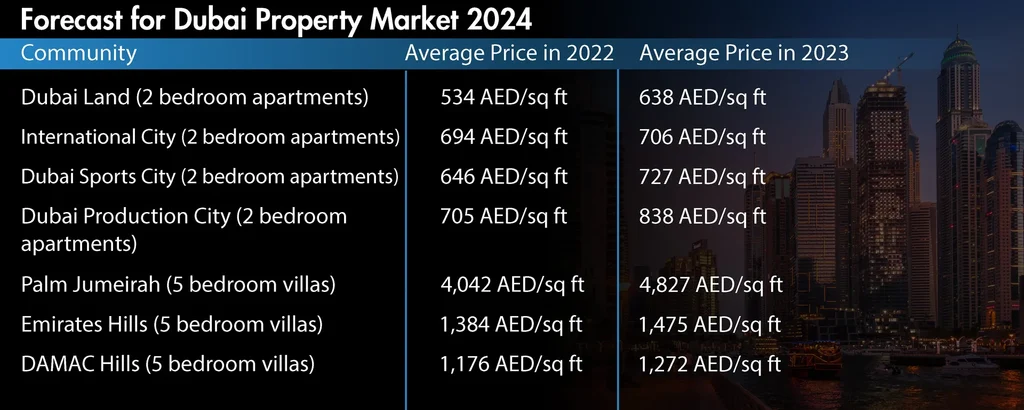

Forecast for Dubai Property Market 2024

Dubai's Economic Conditions connects to the domains of tourism, trade, and finance. Expert projections suggest a steady 2% growth in Dubai's economy.

This mirrors an expected increase in population at a parallel rate. These signs create a favorable environment, paving the way for sustained growth within the real estate sector. Furthermore, Knight Frank lends its expertise forecasting a 3.5% price growth in the mainstream residential market. Additionally, with a robust 5% upswing in prime residential areas. In a nutshell, the forecast for the Dubai property market shows that it will grow. More importantly, it will thrive as one of the most rapidly advancing residential markets around the world. According to our research, prices shoot up in 2022 and 2023 both in affordable housing and luxury residences.

These numbers are expected to stay stable or have minimal fluctuations during this year’s anticipated slowdown.

Moreover, Knightfrank’s research proves that luxury Dubai’s 2024 Real Estate Market Demands remain in strong demand. This, in terms of accounting for 4.8% of total value transactions in the city. All within the first nine months of the year 2023.

These prime submarkets include Palm Jumeirah, Emirates Hills, and Jumeirah Bay Islands. But these prime residences are still more reasonably priced than in other cities and with much better caliber.

A 3 bedroom 3 bathroom townhouse in Palm Jumeirah costs on average AED 3,650,000 or around 993,792 USD. It has an average size of 346 sqm. Meanwhile, a 3 bedroom 3 bathroom townhouse in New York costs on average 1,075,000 USD for a 202.34 sq m residence.

Dubai property market trends 2024

Investors seeking prime residential opportunities in Dubai needs to consider a range of property types:

Residential Properties

Commercial Properties

The commercial Dubai’s 2024 Real Estate Market Demands sector in Dubai also presents enticing opportunities. This is especially true for those with a keen eye on return potential. As with residential properties, the choice of commercial space should align with specific business needs and affordability considerations. Apil Properties acknowledges the significance of these decisions and offers personalized assistance in navigating inquiries about ideal living areas, booking fees, and more.

Growth Prospects in Dubai Property Market

For those considering the investment in Dubai’s 2024 Real Estate Market Demands, the right time may have arrived. The economic trajectory for the past two years, from 2022 to 2023, witnessed substantial growth. This upward trajectory gears 2024 up the market and is to continue to do so.

Furthermore, there’s an anticipated 20% to 25% annual increase in home prices.

Factors Driving Growth in the Real Estate Sector

Factors Driving Growth in the Real Estate Sector

Economic Indicators

Market Supply and Demand

Government Policies and Regulations

Infrastructure and Development

Investor Confidence

Currency Exchange Rates

Economic Indicators

Dubai’s 2024 Real Estate Market Demands closely aligns with its economic performance. GDP growth, employment rates, and overall economic stability significantly affect property prices. Economic growth usually leads to increased demand and higher prices. Meanwhile, downturns can result in lower demand and reduced prices.With a looming downturn in the middle of 2024 for Dubai’s 2024 Real Estate Market Demands, this can present an opportunity for investors. Particularly if you’re looking for properties in Dubai at a lower price or find more favorable conditions.

Furthermore, if you're using a loan to buy your property, there are things to consider. Remember that changes in interest rates can impact how much you pay each month on your mortgage. Zawya reports that more property buyers would choose mortgages as the interest rates are expected to drop in 2024. Property buyers in the UAE in 2024, particularly end-users, might show a growing inclination towards mortgage arrangements. This shift attributes to the reduction of interest rates by up to 100 basis points. According to real estate analysts, alterations in mortgage rates carry substantial influence. Especially on the strategic considerations of buyers in the UAE property market. Many renters in the country may become homeowners in 2024, according to analysts.

Market Supply and Demand

Meanwhile, apartments are 10%-20% lower due to a historical overstock.However, this slowdown will not have significant market disruption. Instead, we believe price rises will slow and possibly reverse over the next 12-18 months, with price decreases not surpassing 5%-10%. Which is a good opportunity for buyers and investors alike. Pre-sales might also slow down, but remain solid for Dubai’s 2024 Real Estate Market Demands.

Additionally, the integration of blockchain technology might change real estate property dealings. As this offers increased speed, security, and access. This digital leap forward not only optimizes processes. But also solidifies Dubai's reputation as a hub of efficiency and innovation.

Government Policies and Regulations

Policies like property ownership laws for foreigners, visa regulations, and taxation. Changes in these policies can trigger shifts in market dynamics and affect property prices. Dubai’s government has adopted several laws to help stabilize the Dubai’s 2024 Real Estate Market Demands. However, regulatory or policy changes might have an impact on the investment climate. Keep an eye out for any revisions to property laws and regulations for Dubai’s 2024 Real Estate Market Demands.

Infrastructure and Development

The appeal of an area also commonly depends on infrastructure projects, leading to increased demand and price.

Top 3 Visionary Projects:

Dubai Creek Tower is by Emaar Properties in Dubai Creek Harbour. It showcases a visionary area set to surpass the Burj Khalifa with a completion date in 2025.

Marsa Al Arab is a captivating development that features two islands flanking the iconic Burj Al Arab. This superyacht-inspired haven includes 303 sea-facing rooms. It has private pools, a resort, a marine park, a theater, a yacht club, and a helipad.

Burj Binghatti locates itself in the Business Bay District. It also has a distinctive creation by Jacob Arabo, featuring a standout honeycomb design. To add, it soars to 200 meters with over 112 storeys. It also aspires to claim the title of the world's tallest residential tower by 2026.

Investor Confidence

Investor confidence and market perception drive buying and selling decisions. Investors play a crucial role in affecting demand and supply and thus, property prices. Dubai is an appealing place for investors especially for foreign investors. This mostly accounts for Dubai’s dynamic economy. Foreign investors have contributed to continued robust demand. Dubai has remained remarkably resistant to external

challenges from the slowing global economy, echoing its resilience during the pandemic.

Dubai benefits from a diverse economy. It has performed well since the pandemic, despite higher corporate funding costs and persistent inflation. With Dubai’s reputation as a place with good investment prospects, it also becomes appealing for immigrants. Both inward migration and natural growth contribute to Dubai's growing population. It stimulates demand for housing and other real estate properties, eventually pulling the real estate market upward.

Currency Exchange Rates

Fluctuations in currency exchange rates may impact property affordability for foreign investors. Dubai’s currency is tied to the US dollar so fluctuations in the dollar can also affect the dirham. For individuals investing from overseas, currency fluctuations might affect your return on investment. Especially when converting profits back to your local currency. So you need to take note of this fact.

Future Expansion Plans

Transportation Networks

Some initiatives aim to redefine how residents and visitors navigate through the city. Such as the expansion of the metro network, introduction of autonomous vehicles, and the Hyperloop.

Smart City Initiatives

From smart grids and waste management to the integration of artificial intelligence, these initiatives improve efficiency, sustainability, and the overall quality of urban life.

Sustainable Urban Planning

Dubai is embracing sustainable urban planning. The Dubai 2040 Urban Master Plan envisions a city that embraces green spaces, pedestrian-friendly zones. As well as eco-friendly architecture, aligning with global sustainability goals.

Potential Challenges

Investing in property in Dubai, like any other real estate market, entails some risks. Before jumping into any financial decisions, it's critical to dive deep and consider these issues. Keep in mind that economic, political, and market events can affect the Dubai's 2024 Real Estate Market Demands.

Oversupply Issues and Currency Fluctuations

Dubai has seen periods of surplus supply in its real estate market. This is due to an imbalance between the availability and demand for houses. This circumstance often has a negative impact on property values and rental returns.

Moreover, while Dubai’s currency is pegged to the US dollar, it is nonetheless vulnerable to exchange rate changes. Another factor to consider is also geopolitical risks.

To add, the Middle East, including Dubai, has faced geopolitical conflicts. Additionally, these dynamics have the potential to influence the region’s overall stability. As a result, these tensions are likely to have an impact on Dubai’s real estate market.

Market volatility and Economic Conditions

Dubai’s 2024 Real Estate Market Demandsmarket is not immune to market swings and changes. Economic downturns, changes in government policy, and worldwide market circumstances can all influence property values and demand.

Dubai’s 2024 Real Estate Market Demands connect to the region’s general economic health. If things become unsteady or decline, property demand may suffer, affecting rental income and property values.

This year 2024, although forecasted to slow down, would not have an immense impact on the overall economic health of the city.

Why Dubai Remains as a Great Investment Prospect?

Dubai remains as an investment haven in 2024. Why? Because it offers endless possibilities to build wealth and secure a successful future.

Tax-free

Dubai’s tax-free allure is a game changer for smart investors looking for stable and rewarding prospects. Dubai is a one-of-a-kind haven for investors looking to develop their fortune. This is because it has no income, property, or capital gains taxes.

Booming Economy

Dubai’s economy is on the rise, thanks to its advantageous location and business-friendly legislation. Additionally, it is quickly becoming a busy hub for trade and commerce. The increase in economic activity has increased demand for real estate. This drives the construction and sale of both commercial and luxury residential homes.

Safe and Stable

Dubai’s image as a safe and stable city attracts real estate investors. The city is a great investment destination due to its low crime rates and security. The government show their dedication to safety through surveillance systems, a committed police force, and strict laws.

Competitive Property Prices

In comparison to other big cities, Dubai’s real estate prices are surprisingly inexpensive, allowing for more economical investment choices. This is, from studio flats to luxury villas and business premises. Overall, the market provides a wide range of possibilities at a variety of prices.

FAQs

Dubai's property market trends 2024 are technology integration, sustainable development, and a rising demand for luxury housing.

Dubai's property market sets for substantial growth in 2024. Also, with steady economic expansion, visionary projects like the Dubai Creek Tower, and a forecasted increase in property prices.

Investors can explore a range of opportunities. That is, from residential properties like villas, apartments, and penthouses. As well as, to promising prospects in the commercial real estate sector.

The increased demand for luxury housing is due to affluent individuals. The market reflects a growing environmental consciousness, with developers responding to this trend with sustainable projects.

Latest Projects in Dubai

Adil Adil

Share This Post

Found this information useful? Share it with your friends and family!

Leave your information so that our expert can consult you in the best way possible

Share your details for personalized expert guidance – let us assist you in the most effective way!

Head Office

Supreme Court Complex – 5 – 1st Floor – Office No: 112 Riyadh St – Umm Hurair 2 – Umm Hurair 1 – Dubai

Email:Info@apilproperties.com

Landline: +97145516626

Whatsapp: +971509026757

- Shall we call you back?

Head Office

Boulevard Plaza, Tower 1 – Suite 1102 – Downtown Dubai

Email:admin@offplan.apilproperties.com

Landline: +97145516626

Whatsapp: +971509026757

- Shall we call you back?