Best Dubai Property for First Investment: A Guide

Dubai’s real estate market has been grabbing attention from investors lately. Thanks to its growing economy, business-friendly vibes, and growing population, it’s becoming a hot spot for real estate ventures. But if you’re new to this game, choosing the right kind of property can feel like a puzzle. But what type of property is best for the first investment?

When you're diving into real estate, you've got to think about where the property is, what kind of property it is, and how much it costs. First things first – figure out what you want and how much you can spend. Once you've got that sorted, it's time to check out the different types of properties in Dubai and weigh the good and not-so-good things about each one.

Dubai has all sorts of properties – apartments, villas, townhouses, and spots for businesses. Each type of property has its good things and challenges, depending on what you want and how much you can spend. Apartments are cool for newbies because they cost less, are easier to take care of, and can bring in good rent money. But if you've got more to spend, villas and townhouses give you more space and privacy.

So, if you're stepping into the world of real estate in Dubai for the first time, keep these things in mind. They'll help you make smart choices and set you on the path to a successful investment.

Understanding Dubai's Property Market

Dubai’s real estate landscape stands as a dynamic and rapidly expanding sector, drawing considerable attention from investors globally.

Attributed to the emirate's impeccable infrastructure, iconic skyline, and investor-friendly policies, it has become a sought-after destination for both local and international investors.

For those considering entry into Dubai's real estate market, a diverse array of options awaits consideration for the best Dubai property for first investment:

Types of Properties Available

- 1. Apartments:

- Representing a ubiquitous presence, apartments offer versatility in terms of size, style, and location.

- Noteworthy for their affordability, they appeal particularly to first-time investors, presenting an attractive proposition with favorable rental yields.

- Villas and Townhouses:

- Catering to individuals with a penchant for luxury, villas, and townhouses stand as prime choices.

- Exclusive communities such as Emirates Hills, Arabian Ranches, and Jumeirah Golf Estates feature these upscale properties, promising both elevated living standards and substantial returns on investment.

- Commercial Properties:

- Tailored for those with a long-term investment horizon, commercial properties emerge as strategic choices.

- Witnessing rapid growth, Dubai’s commercial property market introduces new developments regularly, offering compelling prospects with high rental returns and sustained capital appreciation.

In essence, whether one’s preference leans toward residential comfort, luxury living, or enduring commercial investments, Dubai’s real estate market accommodates a spectrum of preferences for astute investors.

Current Market Trends

Dubai’s property market has demonstrated robust and consistent growth in recent years, propelled by robust demand from both local and international investors.

In the year 2022, sales transactions exhibited a remarkable surge, escalating by 61.5% to reach an impressive figure of 97,448. Concurrently, the total market value experienced a substantial upswing, soaring by 78.1% to an impressive AED 265.51 billion.

Noteworthy among the prevailing market dynamics is the escalating demand for off-plan properties. These are properties that are either under construction or have not reached completion. Investors are increasingly drawn to the allure of off-plan properties, enticed by the prospect of acquiring assets at a more economical initial cost and positioning themselves for substantial long-term capital appreciation. This trend reflects the discerning investment choices made by investors navigating Dubai’s dynamic real estate landscape.

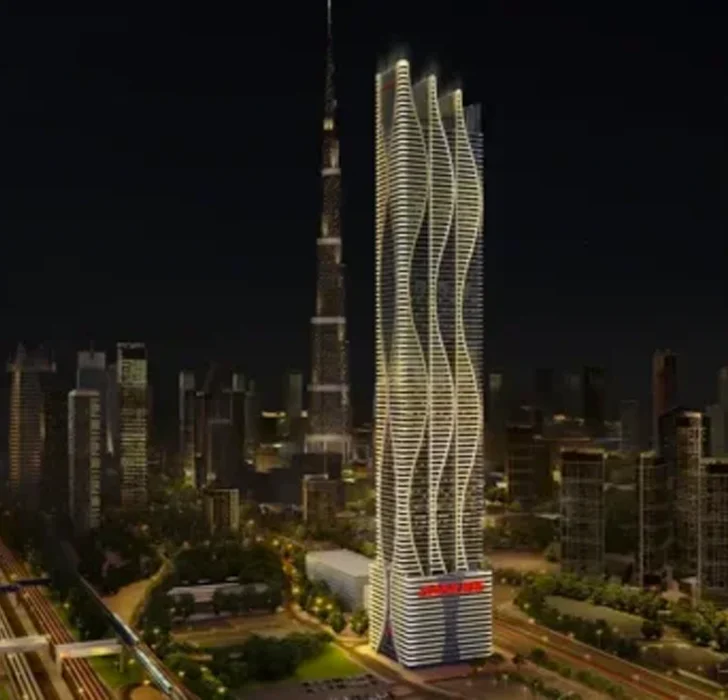

Most Trending Projects in Dubai for You to Pick.

Strategies for First-Time Investors

Investing in Dubai’s real estate market holds significant potential for wealth accumulation, even for first-time investors. So how to buy your first investment property with no money? While it may seem like a complex endeavor, here are some strategies to guide you on your investment journey:

1. Investing with Limited Capital

Contrary to common belief, substantial capital is not always a prerequisite for property investment. For those without significant funds, exploring options such as seller financing can be advantageous. In seller financing, the property seller provides financial support to the buyer, offering a viable avenue for those with limited upfront capital.

2. Partnerships for Collective Investment

Collaborative investment through partnerships is another avenue for first-time investors. By pooling resources with other investors, you can collectively acquire a property. This approach spreads the financial responsibility and risk, making it more feasible for individuals with constrained individual budgets.

3. Affordability Assessment

Assessing affordability is a crucial step before embarking on any property investment. Evaluate your current financial situation to determine a realistic investment amount. Calculating your debt-to-income ratio, which represents the percentage of your monthly income allocated to debt payments, helps gauge financial capacity. A lower ratio indicates more disposable income for investment.

4. Credit Score Consideration

Your credit score plays a pivotal role in determining your eligibility for loans and their associated interest rates. A higher credit score enhances the likelihood of loan approval with favorable terms. Securing a loan with a lower interest rate can translate into significant savings over the loan’s duration, making property investment more financially viable.

Profitability and Investment Types

Delving into Dubai’s real estate market, especially with rental properties, can open doors to lucrative opportunities for investors. Here’s a simplified yet formal overview to guide beginners in making informed decisions before choosing which is the best property for their first investment in Dubai:

1. Understanding Rental Property Profitability

Rental properties in Dubai boast an average return on investment (ROI) of 5.18%. However, it’s crucial to note that the most profitable property types vary based on location, property type, and market trends.

2. Lucrative Areas for Beginners

For novice investors, areas like Jumeirah Lake Towers (with an ROI of 6.82%) and Dubai Marina (boasting an ROI of 6.45%) stand out as profitable options. These locations are favored by expats and offer diverse amenities, making them appealing to potential tenants.

3. Choosing the Right Investment for Beginners: Apartments

For those stepping into Dubai’s real estate market for the first time, apartments emerge as the best investment choice. They are more affordable than villas or townhouses and present a larger pool of potential tenants.

4. Location's Impact on Investment

Considering the property’s location is paramount. Areas with high expat demand, such as Dubai Marina and Downtown Dubai, often experience increased demand for rental properties, leading to higher rental yields.

5. Determining if a Rental Property is a Good Investment

Ensuring a rental property is a wise investment requires diligent research. Factors like location, property condition, and potential rental income should be thoroughly examined.

FAQs

Dubai's dynamic and rapidly growing real estate market offers numerous advantages for newcomers. The city's strategic location, modern infrastructure, stable political environment, tax-free living, high quality of life, and multicultural atmosphere make it an ideal destination for investors.

Several neighborhoods stand out for high returns on investment for first-time buyers in Dubai. Popular areas include Dubai Marina, Downtown Dubai, Jumeirah Village Circle, and Business Bay, providing a range of properties with access to amenities like shopping malls, restaurants, and entertainment venues.

The UAE real estate market's trends and fluctuations can significantly impact first-time property investors. Staying informed about market trends, supply and demand dynamics, economic growth, and government policies is crucial for making well-informed investment decisions.

When choosing between a villa and an apartment in Dubai, investors should weigh factors such as budget, lifestyle, and investment goals. Villas offer more space and privacy, while apartments are more affordable and often come with various amenities. Location, whether suburban or urban, is another key consideration.

Yes, specific regulations apply to foreign investors purchasing property in Dubai. Non-GCC nationals need to obtain a residence visa to buy property, and there are restrictions on property types. Additionally, investors should be aware of associated fees and taxes.

Economic factors like cloud seeding can impact the Dubai property market. While cloud seeding aims to increase rainfall, it may lead to higher humidity and affect tourism, influencing property market dynamics. Investors should consider these factors when making investment decisions.

Most Trending Projects in Dubai

Leave your information so that our expert can consult you in the best way possible

Share your details for personalized expert guidance – let us assist you in the most effective way!

Head Office

Supreme Court Complex – 5 – 1st Floor – Office No: 112 Riyadh St – Umm Hurair 2 – Umm Hurair 1 – Dubai

Email:Info@apilproperties.com

Landline: +97145516626

Whatsapp: +971509026757

- Shall we call you back?

Head Office

Boulevard Plaza, Tower 1 – Suite 1102 – Downtown Dubai

Email:admin@offplan.apilproperties.com

Landline: +97145516626

Whatsapp: +971509026757

- Shall we call you back?